MPC expected to keep current situation unchanged for 8th consecutive time

The committee of six members responsible for determining India's repo rate will begin their meeting on June 5 and conclude on June 7.

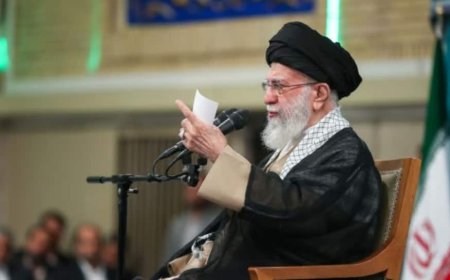

RBI Governor Shaktikanta Das leads a panel with three external members. Shaktikanta Das' tenure as the RBI Governor is scheduled to conclude this December. Shashanka Bhide, Ashima Goyal, Jayanth R Varma, Rajiv Ranjan, and Michael Debabrata Patra also belong to MPC. Each MPC member has one vote, and if there is a tie, the Governor can cast a second vote.

The Monetary Policy Committee of the Reserve Bank of India will begin its three-day meeting on Wednesday (June 5), following the Lok Sabha election results. The six-member committee responsible for determining India's repo rate will begin their meeting on June 5 and conclude on June 7. The rate has a direct effect on banks' borrowing costs and also has an indirect impact on loan interest rates for businesses and individuals. RBI Governor Shaktikanta Das is set to reveal the committee's ruling on interest rates at 10 am on June 7.

This is the RBI MPC's second meeting in the financial year FY2025, which began on April 1, and the third meeting in 2024 following the February Policy meeting held from February 6-8. The Monetary Policy Committee routinely gathers for a 3-day duration before revealing their decision after the same 3-day time frame. The upcoming RBI MPC meeting is set to take place on August 6. The MPC must convene a minimum of four times annually.

The examination conducted by the group of six MPC members, headed by Shaktikanta Das, will offer an overview of the approach the central bank plans to take for the current fiscal year, aiming to maintain a delicate equilibrium between supporting growth and keeping inflation within the 4 percent target. Most economists believe the central bank will maintain its repo rate at 6.50 percent following its discussions, sticking to its policy of 'withdrawal of accommodation'.

Experts have also mentioned that the RBI's rate-cut choices will depend on the rate decisions made by the US Fed. Vikrant Mehta, who is the head of Fixed Income at ITI Mutual Fund, mentioned that the Monetary Policy Committee (MPC) will gather from June 5-7, 2024, to assess the policy repo rate and announce the policy stance. Geopolitical volatility increased after the MPC's previous meeting in the first half of April, and while it seems to have calmed down since then, there are still underlying tensions. Moreover, worldwide markets are currently expecting the Federal Reserve to remain on hold for a longer period than initially expected, in comparison to March. Therefore, despite the anticipated decrease in India's headline inflation, we believe that the RBI is not likely to adjust either the policy rate or the policy stance.

The RBI's most recent repo rate hike was by 25 bps on February 8, 2023, bringing it to 6.5 %. A basis point is equal to one percent divided by one hundred. During its meeting in December 2022, the RBI MPC declared the repo rate to be at 6.25 %.

The dates for RBI’s MPC meetings this financial year :

April 3-5, 2024

June 5-7, 2024

August 6-8, 2024

October 7-9, 2024

December 4-6, 2024

February 5-7, 2025

What's Your Reaction?

:max_bytes(150000):strip_icc()/GettyImages-80487462-59833fb6d088c000112fcc2c.jpg)

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/filer/b6/30/b630b48b-7344-4661-9264-186b70531bdc/istock-478831658.jpg)

)

:max_bytes(150000):strip_icc()/GettyImages-173607153-3eb9caf873014f9ab2e3c11cf071d2c9.jpg)

)