Gold Bullion Updates | 19th June 2024

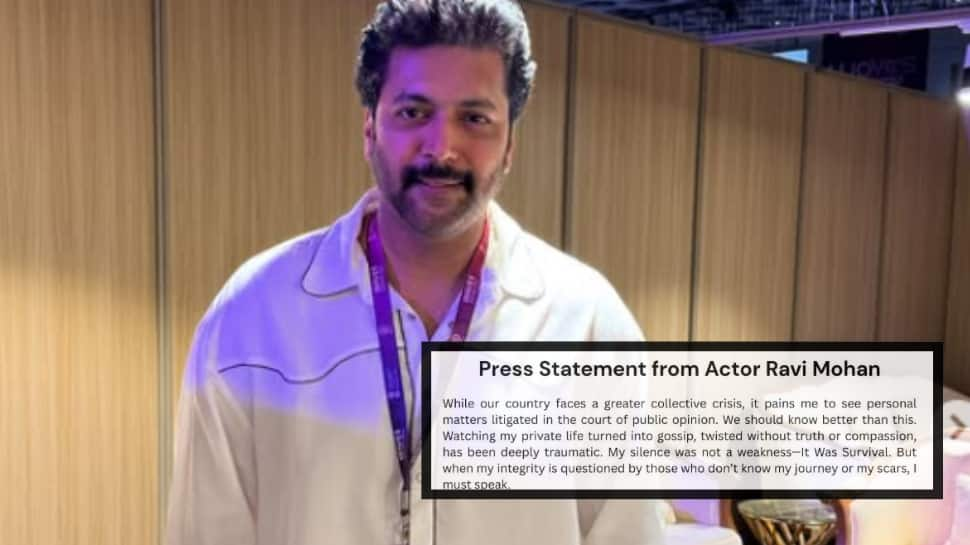

Gold News Updates

- Gold has been trading within a small range since Federal Reserve officials indicated last week that they anticipate only one rate cut this year, rather than the three cuts predicted in March. Recent days have seen an increase in pressure due to aggressive remarks from central bank officials. At the same time, the World Gold Council's report revealed that 29% of central banks plan to increase their gold reserves in the next year - the highest percentage since the survey started in 2018. Central bank purchases have supported gold's impressive surge this year, offsetting the impact of a stronger dollar and changing expectations for interest rates that would normally weaken the value of gold.

- Many central banks are still intending to purchase gold in the upcoming year, driven by increased geopolitical and financial risks. A World Gold Council report states that approximately 20 central banks plan to increase their holdings. Shaokai Fan, the WGC’s global head of central banks, stated that the central banks' actions have not diminished the enthusiasm for gold. Central bank buying is a major topic of interest and uncertainty for the gold market, with official entities playing a significant role in demand, despite incomplete or delayed purchase reporting. According to the most recent WGC survey, numerous central banks, including a growing number of Western institutions, anticipate a reduced importance of the dollar in reserve assets.

- In January, the account showed paper profits totaling 507.3 billion rand, reflecting gains from the central bank's gold, foreign exchange, and forwards or swaps agreements. From July 1 to August 19, lenders can slowly raise their surplus funds deposited with the Reserve Bank and will earn interest at the policy rate, according to a statement released by SARB on Tuesday. It was stated that those who go over the quotas will receive a policy rate of under 100 basis points. Previously, the central bank had specified that it would swap some of the GFECRA liability on its balance sheet with bank reserves instead of using the underlying assets to fund the distribution to Treasury.

FUNDAMENTAL OUTLOOK

Gold and silver prices are currently stagnant in the global markets. Gold and silver prices are anticipated to fluctuate within a range and possibly increase slightly today, as gold prices stabilized following a slight increase in the previous session due to conflicting signals from recent US data on the Federal Reserve's possible shift to monetary easing.

What's Your Reaction?

:max_bytes(150000):strip_icc()/GettyImages-80487462-59833fb6d088c000112fcc2c.jpg)

/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/filer/b6/30/b630b48b-7344-4661-9264-186b70531bdc/istock-478831658.jpg)

)

:max_bytes(150000):strip_icc()/GettyImages-173607153-3eb9caf873014f9ab2e3c11cf071d2c9.jpg)

)